Gail Chiasson, North American Editor

Mark Boidman, managing director, Peter J Solomon Company, New York, gave a talk-and-slide presentation Wednesday morning at the 2015 OAAA/TAB Convention and Expo in San Diego that was full of facts, figures and a selection of graphs that he fully expected would cause controversy.

But Boidman, who compiles a monthly look at the media picture across the US and beyond on behalf of his company has a pretty good finger on the pulse of the Out-of-Home and Digital Out-of-Home industry. And he ended his presentation with some solid recommendations for the industry to gain market share.

But Boidman, who compiles a monthly look at the media picture across the US and beyond on behalf of his company has a pretty good finger on the pulse of the Out-of-Home and Digital Out-of-Home industry. And he ended his presentation with some solid recommendations for the industry to gain market share.

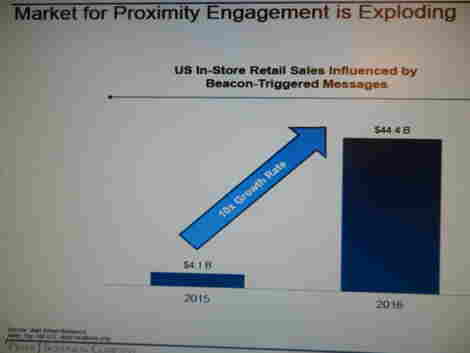

One of the most interesting charts, for me, possibly because I’ve been watching beacon deployment closely, was the one shown below, showing the expected growth in one year of US In-Store Retail Sales Influenced by Beacon-Triggered Messages: from $4.1 billion in 2015 to $44.4 billion in 2016 – a 10X growth in one year.

Boidman, who for the most part didn’t distinguish between OOH and DOOH, said that the OOH industry is faced with numerous challenges: winning its share of ad dollars; measuring and demonstrating clear ROI for ad clients; and the fact that ad buyers and sellers resist change.

He said that OOH companies have been trading at an average of multiples of 11.4 x EBITDA over five years whereas it should be more in the 12.8 x EBITDA range -and the big digital companies like Google and Amazon are way ahead, trading at 20.7 x EBITBA.

“OOH companies are undervalued today,” said Boidman. “Companies like Lamar, Clear Channel Outdoor and OUTFRONT Media should be trading at multiples of about 15.”

While he sees a total five-year ad spend compound growth overall between 2014 and 2019, OOH is the only traditional media expected to grow – but at a small 3.1% – while mobile is expected to grow at 30.3% and digital overall at 11.8%.

TV is really expected to be hit, with major declines in ratings, viewership, and movement of dollars to new media as marketers target hard-to-reach younger viewers. Magazine average monthly audience viewership is shifting to mobile and video. And US marketing professionals are expected to deemphasize most traditional media – except for OOH which is on the bubble.

And when you look at the compound annual growth rate in ad revenue from 2012 to 2015, OOH is in a sorry state (4%) compared to companies like Facebook (30.3%) and YouTube (38.4%)

But hold on, said Boidman. There’s things coming that could change that. Marketers like to emphasize things like online video. The growth of ad blocking and web-ad fraud are OOH positives although a growing concern for advertisers.

“5% of Internet users globally used ad blocking tools in Q2 2014,” said Boidman. “Yes, such tools are already out there and available. And we expect desktop ad blocking will be up 50% in Q2 2014 through Q2 2015.

“Ad blocking tools are, of course, of great concern to the Internet Advertising Bureau, which addressed the issue during its annual leadership meeting in February, and now says it’s a high priority for 2015.”

Further, he said that 54% of all online ad impressions in Q3 2014 were not viewable, and advertisers are wasting money buying online ads that aren’t delivered to people. In fact, advertisers are increasingly asking publishers to guarantee that their ads are viewable.

Solutions providers tend to focus first on innovating in the OOH retail / brand sector vs the OOH ad sector, said Boidman. That sector likely to grow most, followed by the advertising sector, with the sports/entertainment/leisure sector. He quoted Wall Street Research as saying there is a $12 billion OOH Media Retail opportunity vs a $7 billion OOH Ad opportunity.

Boidman pointed out three things specifically hindering the growth of DOOH: lack of research; lack of advertisers (ad revenue); and lack of (provable) ROI.

ROI as a result of advertising is almost always difficult to prove, he said. The fact that buyers have found buying OOH difficult doesn’t help the situation (although much is being done to ease that). And sellers, who make it a point to develop personal relationships with planners and buyers, leading to better sales, recognize that it’s hard to get friendly with an automated platform.

Of course, one cannot ignore that OOH is shifting towards digital and mobile, said Boidman.

“Eighteen months ago, 1% of faces were digital, generating 10% of revenues,” he said. “Six months ago, 2% of faces were digital generating 20% of revenues. Who knows what it will be six months from now! And mobile devices and beacons can make time, location, and context all available and serve as drivers of purchase intent for customers in and around store locations.

“Developments in tracking behavior and user experience will give a much-needed lift to OOH media,” he said. “But OOH operators need to develop a privacy policy.”

And as for the afore-mentioned beacons, Boidman expects that an estimated 60 million to 300 million beacons will be deployed worldwide by 2018. Wi-Fi and beacons and mobile phones allow you to track and follow an actual call-to-action. You can measure the percentage of people who were exposed to or engaged with the ads and subsequently visited a store and/or made a purchase.

And as for more digital place-based networks getting deployed, most are not making money.

“That $7 billion ad bucket may not grow enough to offset the supply of ad faces,” said Boidman. “Not taking share from other ad buckets, and with more faces in the marketplace, isn’t going to help the industry grow. Ad faces are potentially only taking share from each other.

“A possible solution,” he said, “is to ‘Blur the Buckets’ leading to more value and better pricing. Use technology to be/feel more ‘digital’ so that OOH can attract dollars that today go into other ad buckets. Approach mobile and OOH as one product to change the face of OOH attribution and put OOH higher up in the planning as marketing mix is being determined.

“Peter J. Solomon’s recommended changes to the US OOH industry to capture media market share are to use technology:

- Use mobile as infrastructure to enhance OOH value;

- Deploy Beacons and Wi-Fi technologies;

- Evolve to buying ROI as a benefit;

- Use data for better behavioral insights and credibility.”

Another recommendation is to use automated buying (but not programmatic) he said. An open structure / open API marketplace Data Management Platform would allow industry participants to plug and play.

”Each agency would have its own intersection point,” he said. “You would need to include avails for immediate buying at any time of day from any location. And you could use a Data Management Platform to target audiences based on data, and measure which campaigns performed to refine media buys and ad creative over time.”

May 14th, 2015 at 15:10 @673

Good Summary of the presentation. I found it fascinating how aggressively he pushed the industry to immediately build an infrastructure that offers mobile interaction, with a benefit of more accurately validated viewership as well as track-able consumer activity initiated by viewership. The beauty is this has as much relevance to the 98% static signage inventory as to the slowly growing digital faces. Salient point was stop cannibalizing yourselves and find a way to take a larger part of the pie.

May 14th, 2015 at 16:35 @732

Agree. Urgency. I thought his piece fit perfectly with Malcloms.