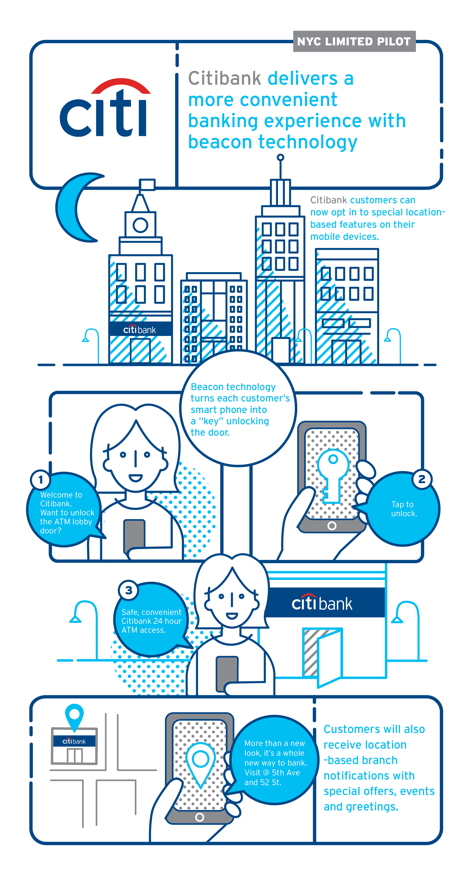

Citibank [1] has deployed Gimbal [2] beacons in select Citi Smart Banking branches in Manhattan.

Citi is one of the first banks to integrate beacon technology into their branches to deliver a more impactful, inviting banking experience with the launch of this pilot program.

Beacons installed at select Citibank branch locations use Bluetooth technology to allow eligible customers gain cardless entry into ATM lobbies after hours using their iPhone or iWatch. Citi customers who opt in can also receive location-based customized messaging.

Citibank’s use of beacon technology is the latest in a series of new technologies the bank is rolling out and exploring. At Citi Smart Banking branches, customers can use iPads and enhanced ATMs to conduct transactions typically reserved for bank tellers.

The bank also launched a voice biometrics solution to seamlessly and automatically verify a customer’s identity within the first few seconds of a customer’s call, in addition to testing biometric, cardless ATMs.

1 Comment To "Citibank Deploys @Gimbal Beacons"

#1 Comment By A Retail Vet On 10 May 2016 @ 12:02 @543

This is actually quite interesting. Working in retail, I’ve seen a good number of ill-conceived beacon projects of late. It seems as if the chasers of shiny things want them to fail. In most cases they think that proximity equals relevance in total.

But banking is entirely different. Most customers will have mobile banking apps from the bank, and they will have push notifications set. The bank will know quite a lot about the customer given the account relationship. And having that data will not seem creepy, because it is a trusted bank and not a more sleight retail relationship. Now you have proximity + first-party data = relevance.