Digital Signage Company Seeking Growth Capital

Adrian J Cotterill, Editor-in-Chief

Based on the description and details placed upon the Private Equity and Venture Capital online platform, PitchBook we thought that this entry ‘Digital Signage Company Seeking Growth Capital‘ was surely non other than ADFLOW Networks but not so says Mike Abbott, President, ADFLOW Networks Inc., in an email exchange with us over the weekend.

The ‘company’ seeking USD 2 million in growth capital plus USD 5 million to acquire a joint venture business is described up on PitchBook as a company that has exclusive recurring revenue, multi-year agreements based on delivery of in-store advertising, coupons, and other content for a number of (other) industry segments.

The ‘company’ seeking USD 2 million in growth capital plus USD 5 million to acquire a joint venture business is described up on PitchBook as a company that has exclusive recurring revenue, multi-year agreements based on delivery of in-store advertising, coupons, and other content for a number of (other) industry segments.

It was those ‘industry segments’ that led us to believe this was ADFLOW, the industry segments are: –

- Leading restaurant association for 5,000+ locations in North America

- National drug store chain comprising 4700+ digital kiosks in North American locations

- Regional and national brands within the QSR segment comprising 5000+ North American locations

Based on the store numbers that national drug store chain is surely Rite Aid? (who we believe, have 4,700 stores and it just so happens that ADFLOW provides blood pressure kiosks to them).

More detail on PitchBook reveals that the Digital Signage Company started in 2003 and is in the ‘digital signage and media products industry for corporate and franchise businesses‘ (the company engages with select national franchisors to establish and operate scalable in-store digital networks to drive recurring advertising revenues and profits).

Furthermore, the PitchBook entry claims that the Digital Signage company in question has signed a deal with a ‘major provider of wireless and PCs in North America’ (we think they mean ‘Canada’ but there you go).

USD 5 million of funds is required to acquire a joint venture company – a company founded in 2002, located in the Southwest United States, that provides a variety of IT services to a blue-chip client base, including Managed and data center services, Software development and integration, Network and infrastructure consulting and Call center services)

If our readers recognise who either of these companies are then of course we’d love to know!

September 24th, 2012 at 13:32 @606

I find the constant discussion of file transfer via TCP/IP under the guise of digital signage to be an effective sleeping aid, but no matter. One must not discount the possibility of the denial defense mechanism being a factor here. The denial pathology often manifests itself when the external reality of the user is too difficult for him/her to bear. To the beholders, the denial is often viewed as lunacy. To wit, “I did not have sex with that woman”.

One might also wonder at the veracity of claims to contractually assured 100% revenue growth and attendant profitability made by a “company” that engages with a third tier intermediary who in turn solicits investors on the Internet. Might not such a story be attractive to venture capitalists for whom $7 million is pocket change? There seems to be pathology, or at best naïveté, at work there as well.

September 24th, 2012 at 13:33 @606

Adrian,

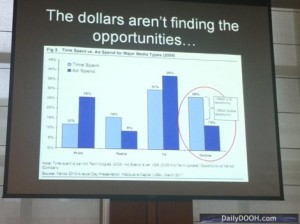

I think the real question or mystery to be solved is how difficult is it STILL to get private equity or VC funds for either start up, growth-expansion, or M&A digital signage projects. With tremendous point-of-sale, point-of-care, and QSR footprint opportunities as mentioned in XYZ’s Pitchbook, what are funders really looking for in order to fund deals? Same question can be asked of the advertising agencies and media planners. Entrepreneurs have been thinking that metrics like those were the slam dunk requirements to get funding and advertising. I am beginning to wonder…..

I guess we will have to wait and see & hear at the Digital Signage Investor conference.

September 25th, 2012 at 17:19 @763

[…] the pitch itself, although I later hazarded a guess at Adflow Networks. A couple of days later, the DailyDOOH was on the case, also speculating that it was Adflow, which seemed to connect some of the dots […]